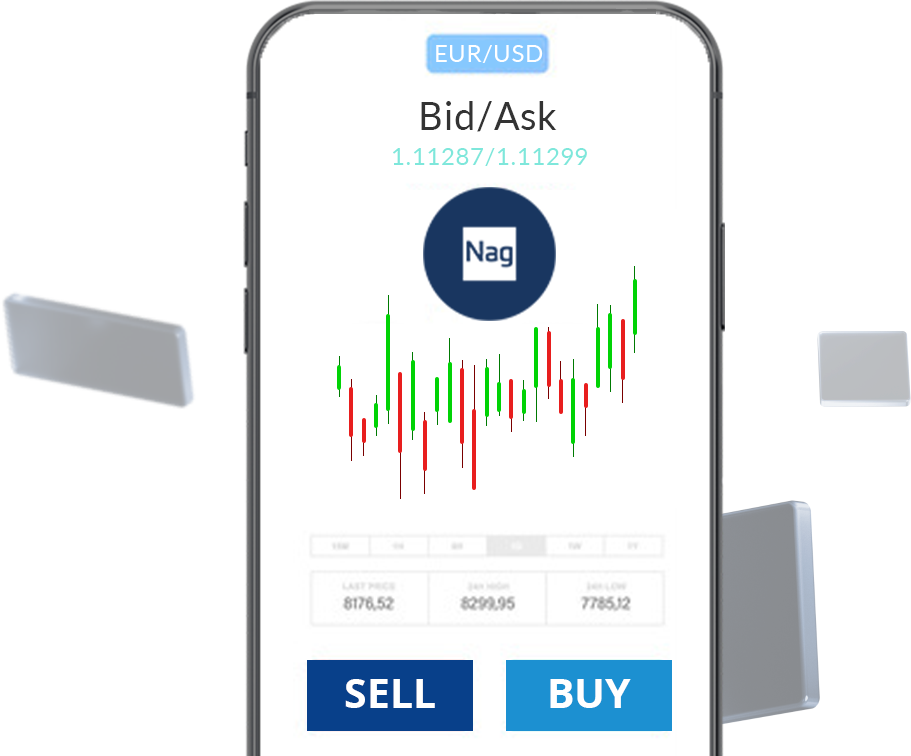

Why trade Forex with NAG Markets?

27 currency pairs on most commonly traded world currencies

Major and minor pairs Competitive spreads

Flexible leverage

What is Forex trading?

Forex trading involves dealing on pairs of currencies and speculating which currency will appreciate in value over the other.

As the world’s most-traded financial market, foreign exchange provides a wealth of opportunities to cash in on currency movements.

What are the benefits of Forex trading?

- 27 currency pairs

- Major and minor pairs Competitive spreads

- Flexible leverage – up to 1:400

- Mini lot from 0.01 lot

- Real-time execution on market price

Product Specification

| Product | Symbol | Typical Spread | Minimum Price Movement/lot | Margin |

|---|---|---|---|---|

Swap Interests will be charged on all open positions over spot products at "End-of-day" time as specified by NAG Markets. 3-days swap interests will be charged every Wednesday for all Forex and Precious Metals Products, whereas a 3-days swaps will be charged every Friday for all Energy and Indices Products except CN50.

Frequently Asked Questions

Click on the “Get Started” button at the top of this page to open an account. You will be asked to fill out an application form. Following completion of the form, you will need to upload some verification documents. Once verified, you will be able to fund your account and start trading.

The default leverage is 1:200 on Forex products. This default leverage can be adjusted to 1:400 subject to review and approval from NAG Markets (Pacific) Limited.

We offer 27 currency pairs which includes all major currencies such as EUR, GBP, JPY and more. Spreads starting from 1.2 pips and for more information, please visit our Product Specification for detail.

There is a wide range of Forex pairs to trade on.

- - Decide on a Forex pair that suits you.

- - Choose whether to buy or sell and open a position.

- - Manage your risk. When you place a trade, it is crucial that you protect yourself against potential losses and excess volatility.

- - Monitor your position. After placing a trade, it is imperative that you watch your position and exit the market to cash in a profit or to limit a loss accordingly.